Common mistakes

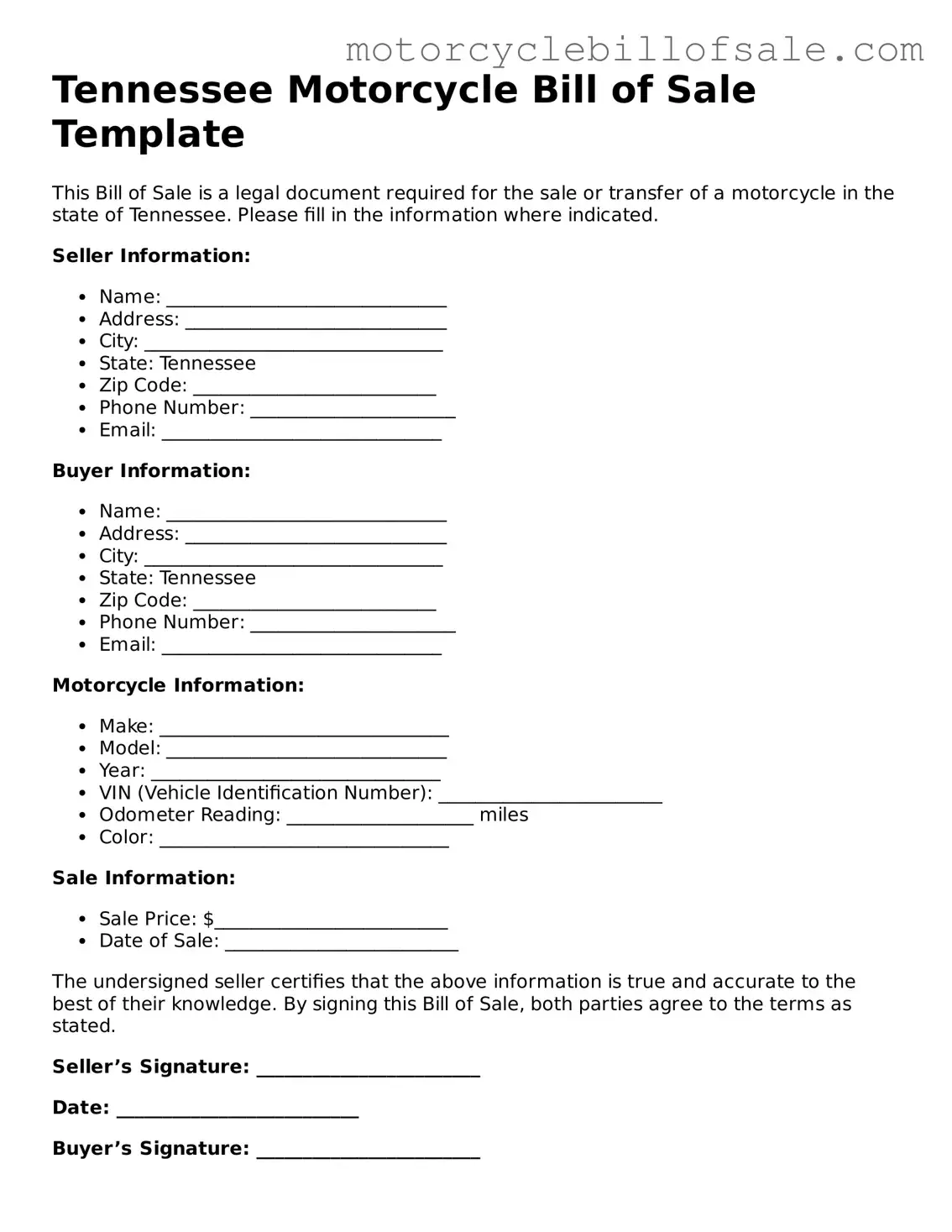

Filling out the Tennessee Motorcycle Bill of Sale form may seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to provide accurate vehicle identification information. This includes the motorcycle's VIN (Vehicle Identification Number), make, model, and year. Omitting or miswriting this information can create issues with registration and title transfer.

Another mistake involves not including the correct sale price. The form requires the sale price to be documented clearly. If the price is left blank or incorrectly stated, it can lead to confusion regarding taxes owed or even disputes between the buyer and seller.

Many people also overlook the importance of signatures. Both the buyer and seller must sign the form for it to be valid. If either party neglects to sign, the document may be rendered ineffective, complicating the transfer process.

Additionally, individuals often forget to date the bill of sale. A date is crucial as it establishes when the transaction took place. Without a date, it may be challenging to prove the timing of the sale, which can be important for legal and tax purposes.

Some individuals fail to provide contact information for both parties. Including full names, addresses, and phone numbers helps ensure that both the buyer and seller can be reached if any issues arise after the sale. This oversight can lead to difficulties in communication later on.

Another common error is neglecting to include a description of the motorcycle's condition. Buyers deserve to know whether the motorcycle is in good working order or has any issues. A lack of detail can result in misunderstandings and dissatisfaction after the sale.

People sometimes misinterpret the form’s requirements regarding notarization. While notarization is not always necessary, certain situations may require it for added protection. Failing to understand this can lead to problems with the validity of the bill of sale.

Lastly, some individuals do not keep a copy of the completed bill of sale for their records. Retaining a copy is essential for both parties, as it serves as proof of the transaction. Without it, resolving any future disputes may become more challenging.